Banks

Digitize debt and risk advisory from pre‑trade to post-trade.

We provide banks and lending specialists with innovative SaaS solutions to digitalize debt and risk advisory business for their corporate, public and institutional clients.

Our software suite consists of two modern web applications that you can use independently or via integrated interfaces.

10+

leading banks

4,000+

clients connected to white label portal

480+

cities or municipal companies

450+

corporate clients

Solutions

Smart solutions for banks and lending specialists

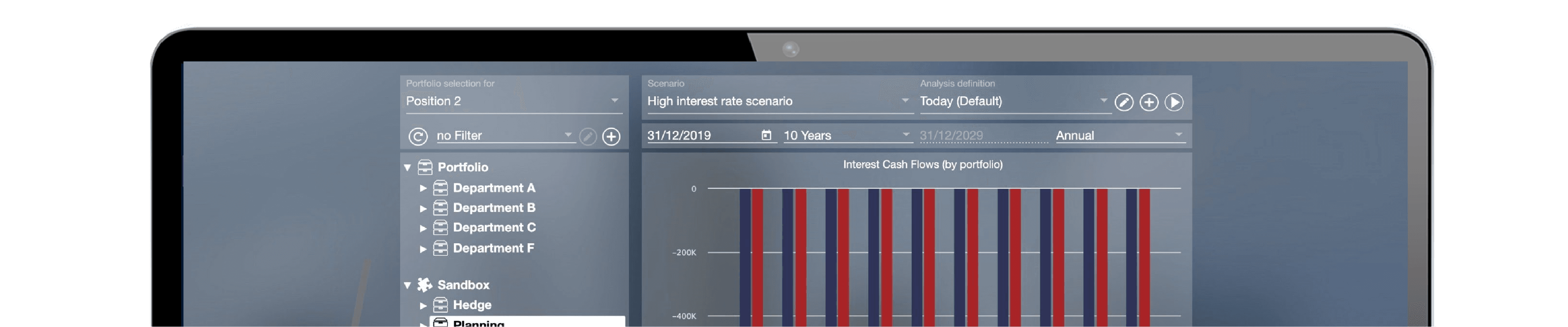

Pre-trade analysis tool for holistic debt and interest rate risk advisory

Verifino is suitable for banks, lending specialists and savings banks. With Verifino you can digitalize your advisory and proposal value chain, from initial analysis to customer meeting. It not only generate new business approaches but also strengthens customer loyalty.

Gain comprehensive insights

Analyse loans and hedging strategies

Simulate liquidity & interest rate risk exposures

Genrate customized results presentations

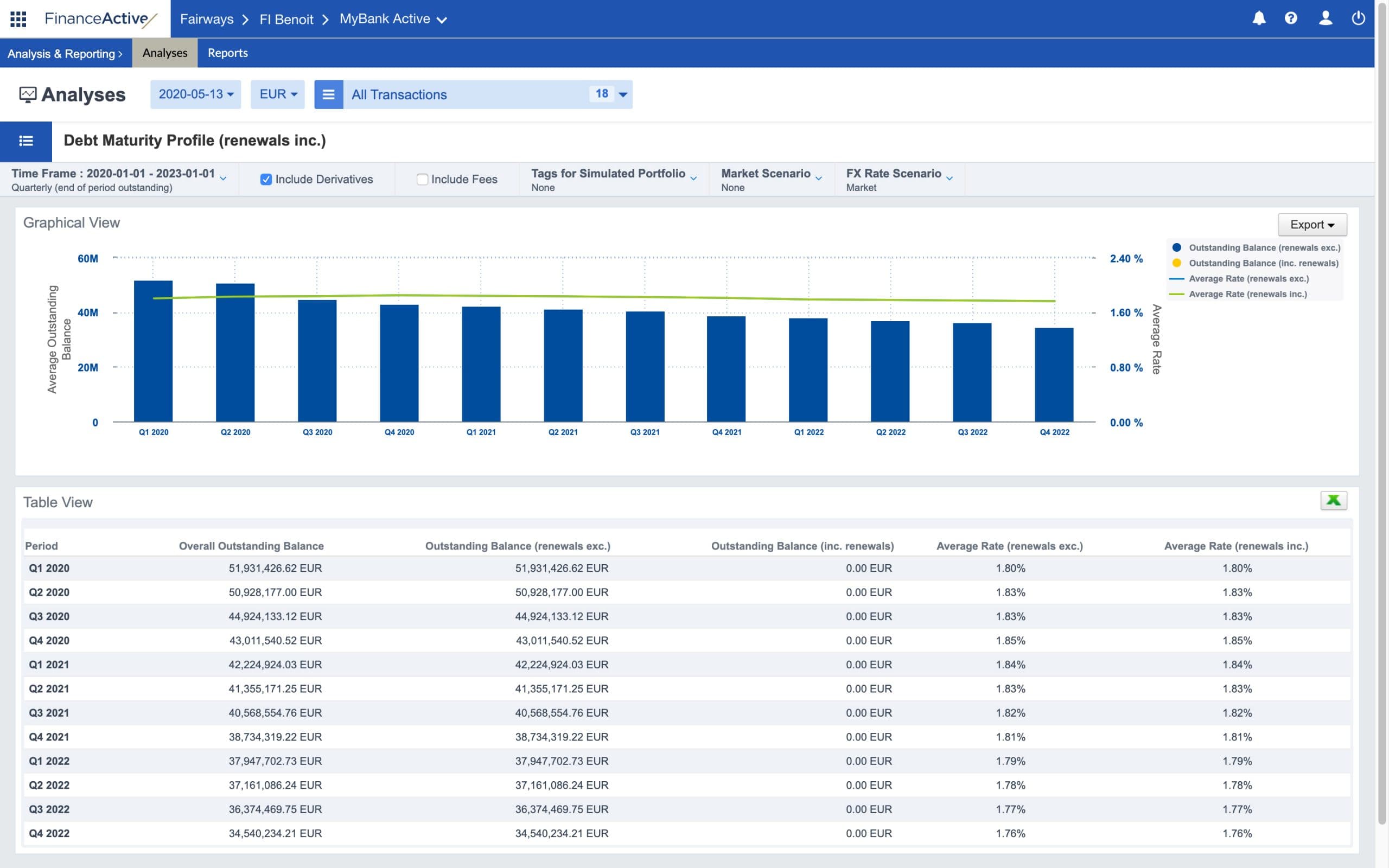

Digital channel for debt management, connecting banks and clients

Fairways is a collaborative solution to digitize debt management with clients. Fully integrated with your back-office systems, our solution opens new perspective in costumer relationship: digitalization, paperless administration and seamless communication. Fairways Debt portal makes your financial control operations easier to run and empowers your clients to drive their decisions.

Visualize debt aggregation & reporting for each of your clients

Share the same data in one place: documents, calendars, agenda

Generate automated billing, request for proposal

WHY VErifino

Verifino is the German company of Finance Active. Verifino is a joint venture which combines the expertise of two leaders in debt management. Finance Active is leader in Europe for SaaS debt and financial risk management solutions for multinational companies, local authorities and financial institutions.

Verifino supports you daily in the performance of your financial operations through a combination of online monitoring tools and dedicated customer service.

Strict data protection and our tested software development process guarantee you careful and secure processing of your data, as well as the highest quality and security when using our software.

Our customers confirm that they have been able to significantly simplify workflows in treasury and finance departments and optimize debt management, when using our software.

Our checked, firmly stored calculation processes generate error-free evaluations, while the customizable overview page provides clarity, even for complex portfolios with many subsidiaries.

Evaluate your balance sheet and create reports instantly with a single click. Transfer data directly to your accounting system and quickly find products using the search and filter function.

Build a solid foundation for future decisions by incorporating up-to-date market data and different interest rate scenarios, allowing you to navigate market fluctuations confidently.

In regular feedback meetings and user group meetings, we learn firsthand about the needs of our customers and can continuously develop the software according to their wishes.